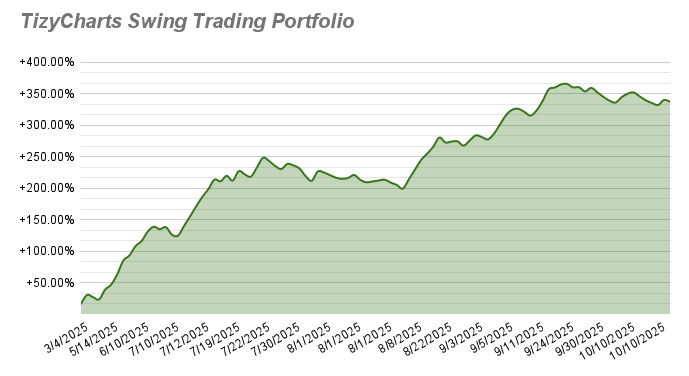

Volatility continues. First stake closed on $COO. Performance still above +300% since March 2025.

📊 Overall Performance (All-In): +331.77%, Balanced +252% (Since 03/2025)

🔖 MENU

1️⃣ My $ES_F View – Where the Market Is Headed

2️⃣ Swing Portfolio Recap

3️⃣ What Happened Today on the Markets

4️⃣ Market Sentiment

5️⃣ The Next Trading Day

🔥 Trending + Volatility Watchlist

🗓️ Next Key Catalysts

📉 Short Interest Radar

📌 Strategy-Based Watchlist (5 Tickers – Expanded)

⭐ My $ES_F View In Depth

🔍 Earnings Radar – In Depth

💸 Options & Flow Highlights

📊 Sector Snapshot

📌 Strategy-Based Additions

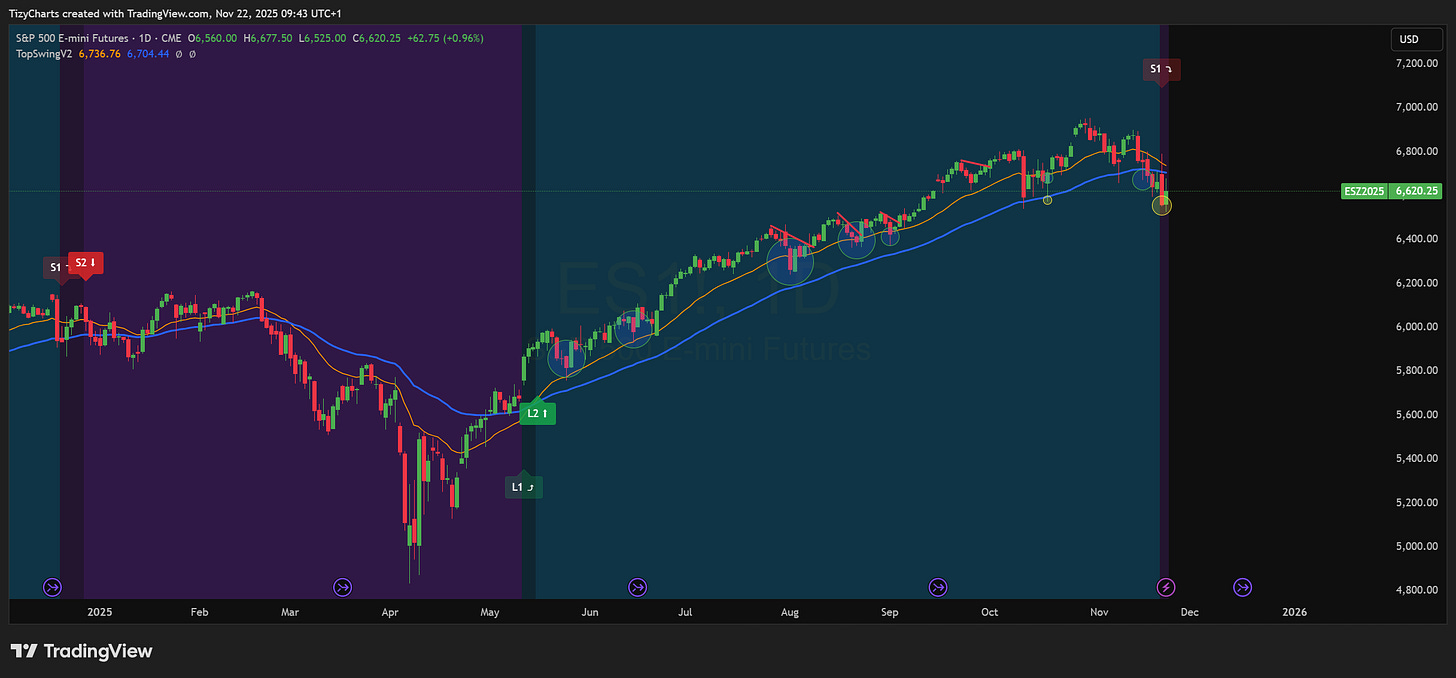

1️⃣ My $ES_F View – Where the Market Is Headed

$ES_F showed another sequence of volatility: green-to-red on Thursday, red-to-green on Friday, but ultimately printed a bearish daily candle again. Structure remains weak: lower low, lower high, and momentum pointing downward. This is the classic signature of a pullback strengthening rather than fading. Bears remain in control of the short-term trend, while bulls have not reclaimed any meaningful level yet. The market continues to be choppy, reactive, and highly sensitive to liquidity pockets.

2️⃣ Swing Portfolio Recap

📈 Performance Chart

📌 Setups Shared Today

None today — the volatility regime continues to remove lower-quality setups.

💼 Portfolio Updates — November 21

$COO — first stake closed.

💹 Open Positions Performance

AR (Long) → –4.17%

EXE (Long) → +4.16%

SKY (Long) → +1.05%

NU (Long) → –0.06%

COF (Short) → –4.98%

LEN (Short) → –4.94%

COO (Long) → +6.39%

👁🗨 Setups On Watch (Untriggered)

$CVX (Short) • $TXT (Short)

📈 Performance Overview

Daily System (since Feb 2, 2025): +208.31%

1-Hour System (since Apr 24, 2025): +123.46%

Performance of Open Trades: –2.56%

Overall Performance (All-In): +331.77%

Overall Performance (Balanced): +252.49%

📌 Portfolio performance is cumulative — not CAGR or compounded.

3️⃣ What Happened Today on the Markets

Friday’s session was another example of how unstable market structure has become. The day opened with weakness across tech and growth, followed by a midday recovery fueled by short-covering and end-of-week positioning. Despite the bounce, the overall structure remains bearish: indices remain below short-term moving averages, and the rally lacked strong breadth.

Semiconductors — the strongest sector for most of the year — continue to signal distribution. Large-cap names like NVDA, AMD, and AVGO experienced heavy two-sided trading but failed to reclaim prior support. This drag has been affecting the broader Nasdaq, which remains fragile.

Energy saw a slight recovery as crude rebounded, but these moves lacked conviction. Utilities and Staples continued to attract defensive flows, confirming rising caution. Small caps remained weak and failed to participate in the midday bounce.

What stood out the most today was the volatility without direction. The market is showing large intraday swings, but the higher timeframe picture is still pointing down. This type of action typically occurs in the middle stages of a pullback, not at the end. Traders should remain selective and focused on Daily structures only.

4️⃣ Market Sentiment

Sentiment remains conflicted but clearly pressured. Traders are oscillating between fear of missing reversals and fear of deeper downside. This emotional tug-of-war is visible in price action: reactive, choppy, and dominated by short-term liquidity rather than sustained trend.

Psychologically, this is where disciplined execution wins and emotional trading loses. Many participants try to pick bottoms during this type of environment, but the structure does not support it. Momentum remains bearish, and the hourly chart is fully aligned to the downside.

Options flow confirms this psychology:

hedging increased,

speculative calls decreased,

but no panic spikes or capitulation signs yet.

This means institutions are positioning cautiously, but not aggressively selling. The absence of fear is dangerous — pullbacks without panic tend to persist longer because there is still hope among retail participants.

The best approach: stay patient, trust levels, and avoid anticipating reversals. Let structure confirm before sizing into any new trend direction.

⚡ FROM PORTFOLIO TO PREPARATION

🟢 THE NEXT TRADING DAY

For Monday’s session the plan is clear:

focus on the reaction around 6540

watch Daily setups with clear direction

avoid names sitting mid-range

be cautious with longs until higher timeframe levels are reclaimed

consider momentum shorts only in structurally aligned names

Volatility will stay elevated — structure is more important than speed.

🔥 Trending + Volatility Watchlist

High-volatility or trend-relevant names:

$NVDA — heavy distribution, two-sided volatility

$TSLA — still wide swings, not reliable intraday

$COIN — crypto-driven volatility persists

$MARA — extended speculative move

$AAPL — stable but stuck in a tightening range

$AMZN — rotation within its consolidation

$SMCI — aggressive intraday spikes

$XOM — strength aligned with crude

$GME — isolated speculative pop

📉 Short Interest Radar

High short interest names showing technical reactions:

$CVNA — tightening compression, high risk

$UPST — wild volatility, setups dangerous

$AFRM — potential squeeze zones remain active

$RBLX — indecision but downside pressure building

$COIN — elevated SI + strong volume

📌 Strategy-Based Watchlist (Expanded)

Across strategies:

1. Trend Continuation Shorts — clean wave patterns forming

2. Breakout + Retest (Bearish) — rejection at resistance

3. Momentum Shorts — accelerating breakdowns

4. Oversold Reversal Attempts — valid only with reclaim

5. High Short Interest Squeeze — watch key volume pivots

🧭 Strategy reference:

👉 https://tizycharts.com/9-powerful-trading-strategies-every-active-trader-should-know/

🚀 Join the TizyCharts Community

👉 Free Telegram Channel: https://t.me/tizycharts

👉 Subscribe (Free & PRO): https://tizycharts.substack.com/subscribe

🔐 PRO subscribers get:

• Exact entry/stop/target levels

• Strategy explanations

• EMA21–EMA50 live charts

• Daily, Hourly, 15-Min setups

• Real-time performance tracking

🔒 Join 500+ traders following my exact execution and portfolio structure.