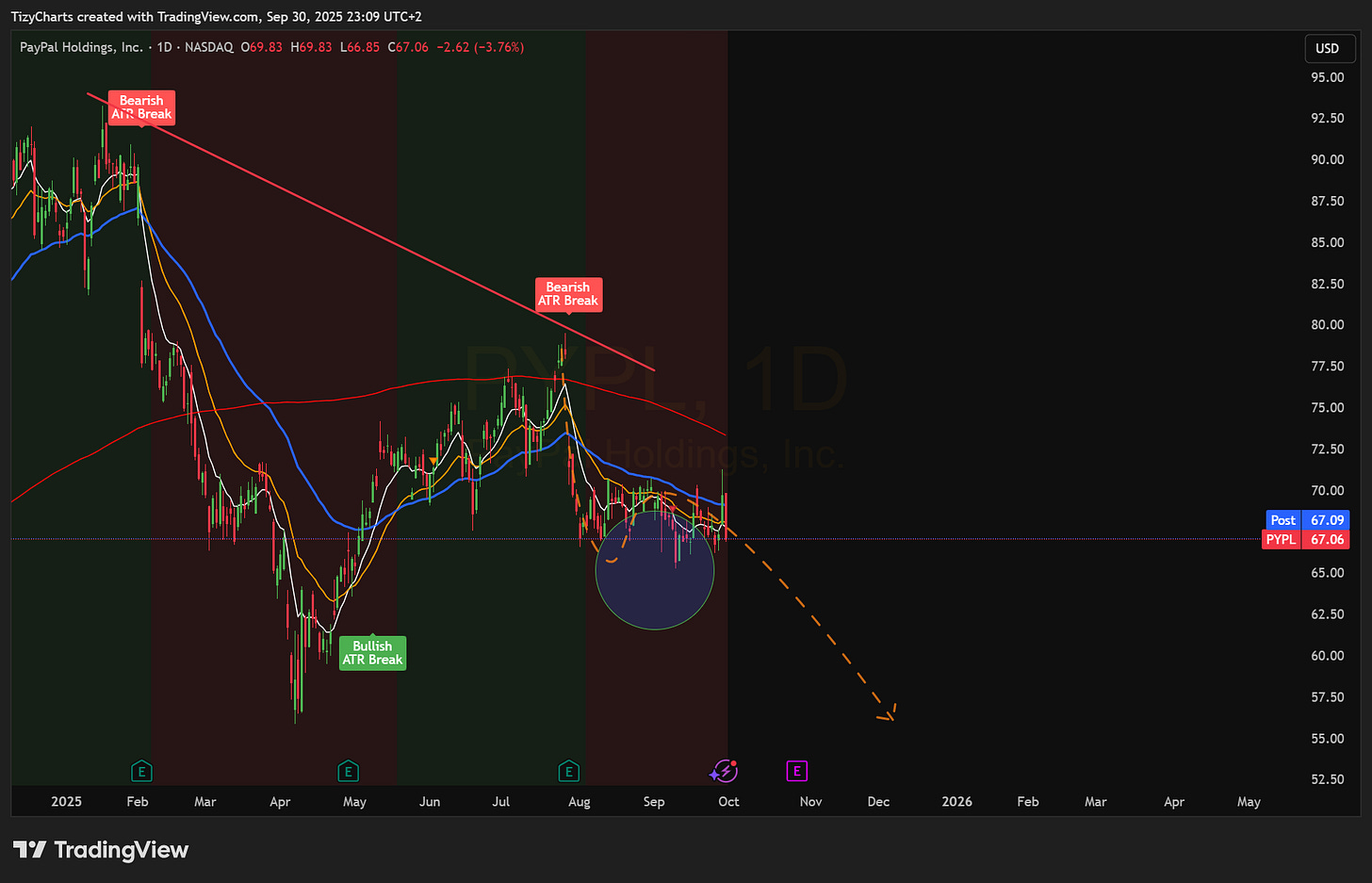

New Setup : $PYPL (Daily, Short)

Entry, Stops, Targets, Risk, Strategy inside. (Swing Portfolio at +350%++ YTD)

🔖 Menu

TizyCharts Note

Analysts’ Rating (free)

Recent Actions (free)

TizyCharts Setup & Chart (Entry / Stop / Target / Strategy)

Detailed Analysts’ Rating with average target price

Portfolio Link

1. TizyCharts Note

PayPal Holdings ($PYPL) is setting up a daily short after breaking below support at 65.27. Selling pressure has been building as digital payment stocks continue to face regulatory scrutiny and slowing transaction growth. With the fintech sector losing momentum, $PYPL remains vulnerable to further downside. The stop is placed at 70.65, defining risk at ~6%.

2. Analysts’ Rating (free)

According to TipRanks, $PYPL carries a Moderate Sell consensus. Analysts remain cautious due to competitive pressure from Apple Pay and CashApp, as well as slowing growth in international volumes.

3. Recent Actions (free)

Peer fintech names $SQ and $BLOCK also failed recent breakout attempts, reversing lower.

Sector breadth continues to weaken, with institutional flows rotating out of payments and into traditional financials.